south dakota excise tax exemption certificate

This is a multi-state form. The South Dakota Streamlined Tax Agreement Certificate of Exemption is utilized for all exempted transactions.

Free 10 Excise Tax Samples In Pdf Ms Word

The sales tax applies to the gross receipts of all retail sales including the sale lease or rental of tangible personal property or any product transferred electronically and the sale of services.

. South Dakota Department of Revenue. South Dakota Department of Revenue. Wayfair 1 Uniform Sales Use Tax Exemption Resale Certificate Multijurisdiction.

84-Insurance company titles vehicleboat and does not pay 4 excise tax. How to fill out the Get And Sign. If the purchaser is from a state that does not.

This is a Streamlined Sales Tax Certificate which is a unified form that can be used to make sales tax exempt purchases in all states that are a member of the Streamlined Sales and Use Tax. South Dakota Vehicle Excise Tax Explained. Tennessee Tax return filing dates for contractors.

MV-609 South Dakota Department of Revenue Division of Motor Vehicles 445 E. Farm Machinery Attachment Units and Irrigation Equipment. South Dakota does not impose a corporate income tax.

Prime Contractors Exemption Certificate. Chapter 10-35 Electric Heating Power Water Gas Companies. State of South Dakota and public or municipal.

To apply the certificate. South Dakota Streamlined Sales Tax Agreement Certificate of Exemption Warning to purchaser. Follow the step-by-step instructions below to design your South Dakota exemption certificate.

South Dakota businesses with permit numbers containing UT use tax or ET contractors excise tax cannot buy products or services for resale. Select the document you want to sign and click Upload. This form can be downloaded on this page.

South Dakota Exemption Certificate Printing and scanning is no longer the best way to manage documents. SDCL 10-45-10 exempts from sales tax the sale of products and services to the following governmental entities. Capitol Avenue Pierre SD 57501-3185 1-800-829-9188 E-mail.

Capitol Avenue Pierre SD 57501-3185 605-773-3541 Fax 605-773-2550 Revised 0616 This form is to be. 31-014c 07282020 Qualifying computer software specified digital. This is a Streamlined Sales Tax Certificate which is a unified form that can be used to make sales tax exempt purchases in all states that are a member of the Streamlined Sales and Use Tax.

Not all states allow all exemptions listed on this form. Capitol Avenue Pierre SD 57501-3185 1-800-829-9188 E-mail. Use this step-by-step instruction to complete the Get And Sign South Dakota Exemption Certificate 2015-2019 Form swiftly and with idEval precision.

South Dakota v. Prime Contractors Exemption Certificate. Chapter 10-33 Telephone Companies including Rural.

Gail Cole Mar 1 2016. Chapter 10-36 Rural Electric Companies. Plates are not removed from vehicle08 92-House trailer subject to 4 initial registration fee upon initial.

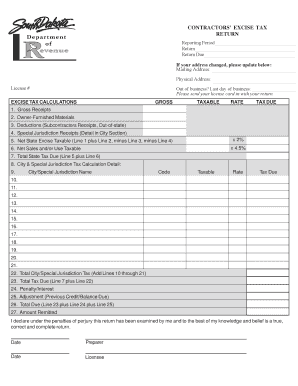

Your request for the title-only sales tax exemption has to be within the required 45 days of the date of purchase and prior to a title being issued. A 2 contractors excise tax is imposed on the gross receipts of all prime and subcontractors engaged in construction services or reality improvement projects.

Sales Taxes In The United States Wikipedia

Prime Contractors Exemption Certificate State Sd Fill And Sign Printable Template Online Us Legal Forms

Contractors Excise Tax Webinar Youtube

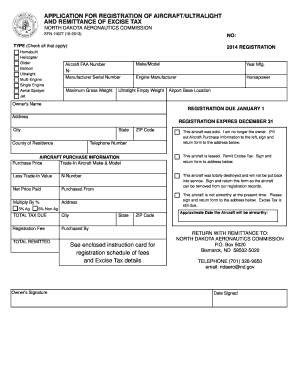

Fillable Online Nd Application For Registration Of Aircraftultralight And Remittance Of Excise Tax Nd Fax Email Print Pdffiller

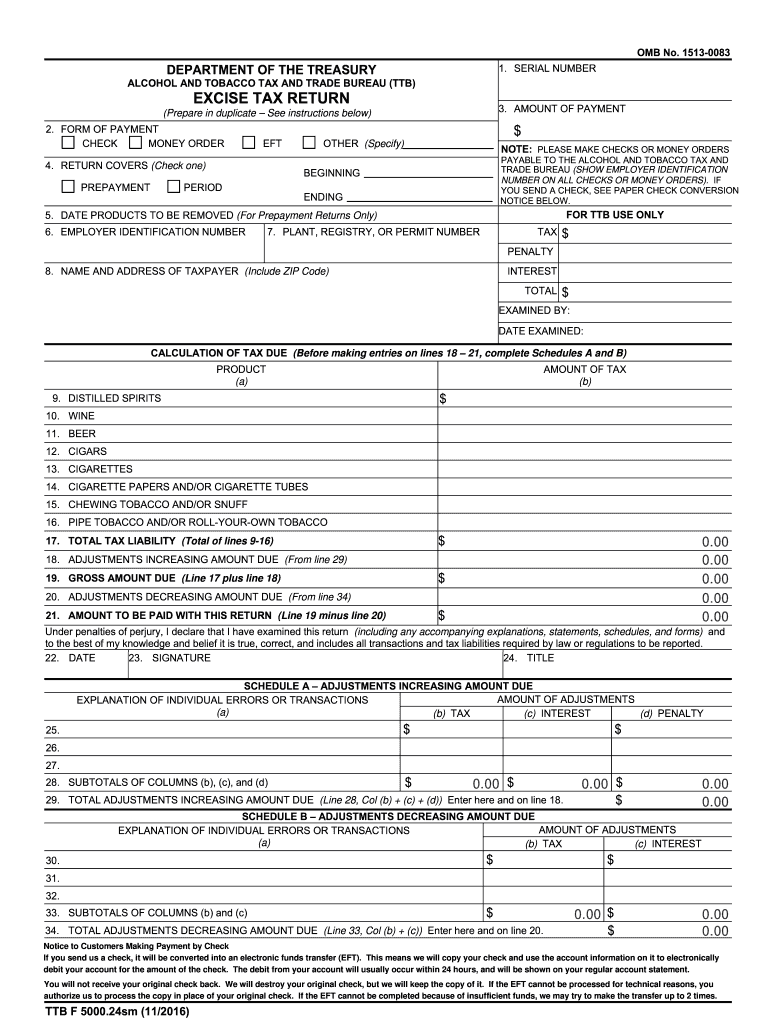

Ttb 5000 24 Fill Out Sign Online Dochub

South Dakota Sales Tax Breaks Consumers Pay While Big Businesses Get Exemptions

Sdform Fill Online Printable Fillable Blank Pdffiller

Excise Tax Ketel Thorstenson Llp

Excise Tax Gift Exemption Form Pdf Fpdf Doc Docx District Of Columbia

South Dakota State Sales Tax To Increase Avalara

South Dakota Taxes Sd State Income Tax Calculator Community Tax

Form Mv 608 Fillable State Of South Dakota Application For Motor Vehicle Title And Registration

Sales Use Tax South Dakota Department Of Revenue

Exemptions From The South Dakota Sales Tax

Form Rv 093 Fillable Sales Tax Exempt Status Application

Sd Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Sd Contractor S Excise Tax Return Formerly Rv 011 Fill Out Tax Template Online

Contractors Be Sure To Get Your Dor Supplies Before You Begin Your Project South Dakota Department Of Revenue