dupage county sales tax on food

Find your ideal DuPage County Used Car Dealership Motorcycle Dealer business or other DuPage County Car Dealership business. Illinois has state sales tax of 625 and allows local governments to collect a local option sales tax of up to 475.

Illinois Sales Tax Audit Basics For Restaurants Bars

Beginning May 2 2022 through September 30 2022 payments may also be mailed to.

. Food Drug Tax 175. Cook County and its surrounding counties also impose a Regional. County Farm Road Wheaton IL 60187.

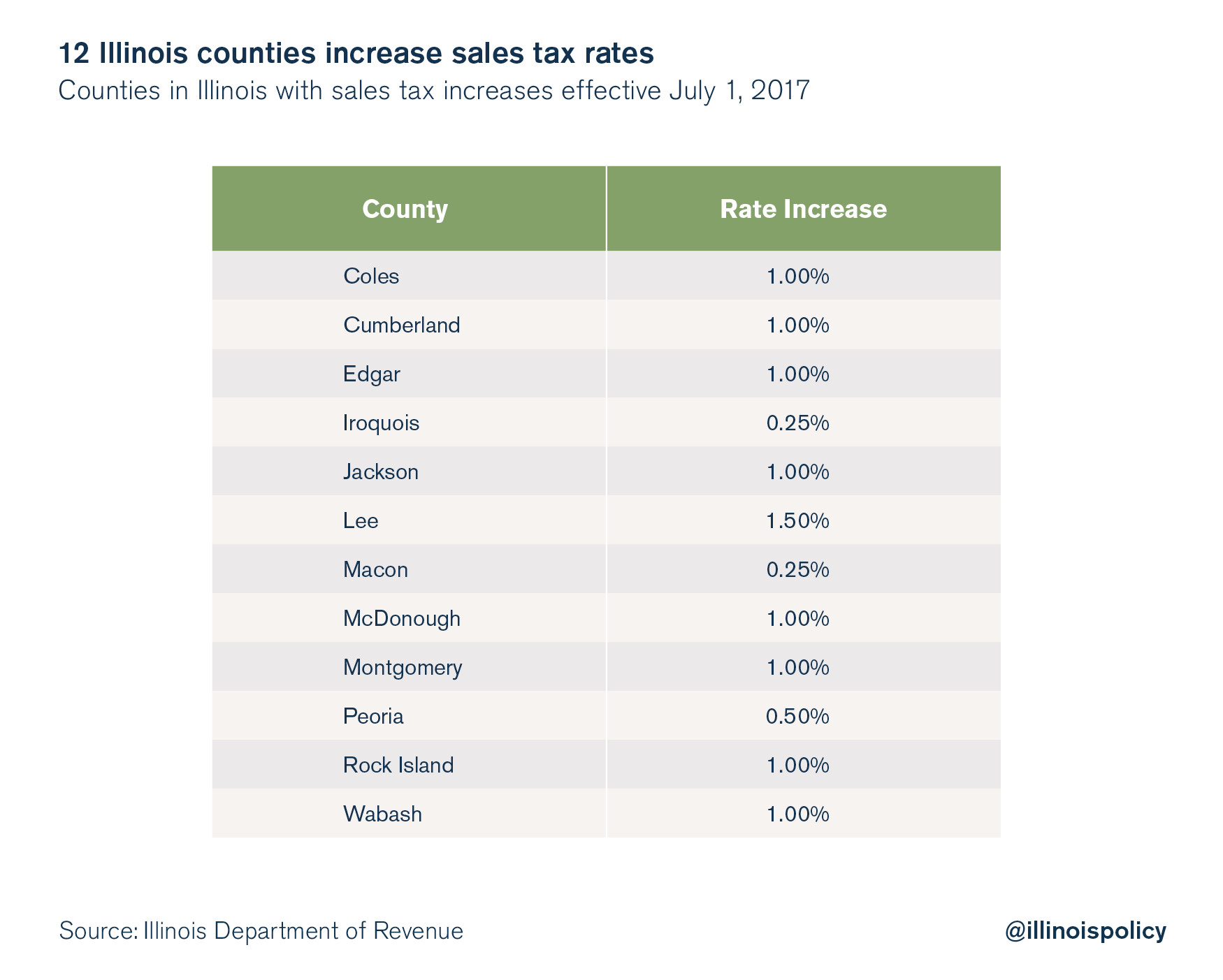

Edgar County IL Sales Tax Rate. There are a total of 495 local tax jurisdictions across the. Restaurant meals and other prepared food and beverages are also subject to a 3 Hanover Park Food and Beverage Tax.

Keep in mind that low property tax rates dont mean a county is the best place to invest in nor do high property tax rates mean a county should be out of the running. Home Rule 1 Sales Tax. 18 hours agoThe agenda for Tuesdays public meeting calls for a presentation about what happened after the county board in October 2019 imposed a 3 retail tax on all sales of recreational marijuana in.

Your property tax bill is made up of payments to a number of separate local government units including county township. The Regional Transportation Authority RTA is authorized to impose a sales tax in Cook DuPage Kane Lake McHenry and Will counties. The Dupage County sales tax rate is.

The Illinois state sales tax rate is currently. 1337 rows 2022 List of Illinois Local Sales Tax Rates. This rate includes any state county city and local sales taxes.

The aggregate rate for sales tax in the DuPage portion of the Village is 800. The Dupage County sales tax rate is. Sales tax returns or The Illinois Department of Revenue Form ST-1 are one of the most commonly audited forms or tax types in our state.

The aggregate rate for sales tax in the DuPage portion of the Village is 800. Average Sales Tax With Local. Choosing to buy your next Toyota model from Toyota of Naperville could save you hundreds or thousands of dollars.

Of this 50 cents of county-wide taxes are for County government use Sales tax is imposed and collected by the state on a sellers receipts from sales of tangible personal property for use or consumption. Tax bills issued in 2019 apply to 2018 taxes. Box 4203 Carol Stream IL 60197-4203.

Property sales Home Rule other taxes. The Illinois sales tax of 625 applies countywide. Sales Tax Create.

Access the Food and Beverage Tax Registration form PDF which. By Annie Hunt Feb 8 2016. Food Drug Tax 175.

Heres how Dupage Countys maximum sales tax rate of 105 compares to other counties around the United States. DuPage County IL Sales Tax Rate. This varies from each city and county.

DuPage County Collector PO. In dupage county its 675 percent and in lake. Kansas Governor Laura Kelly on Wednesday signed a bill that phases out the states food sales tax starting next year.

Higher maximum sales tax than 97 of Illinois counties. One of the reasons for this is that they are difficult to prepare properly. DuPage has a 1838 million general fund which includes the budgets of most county offices and departments.

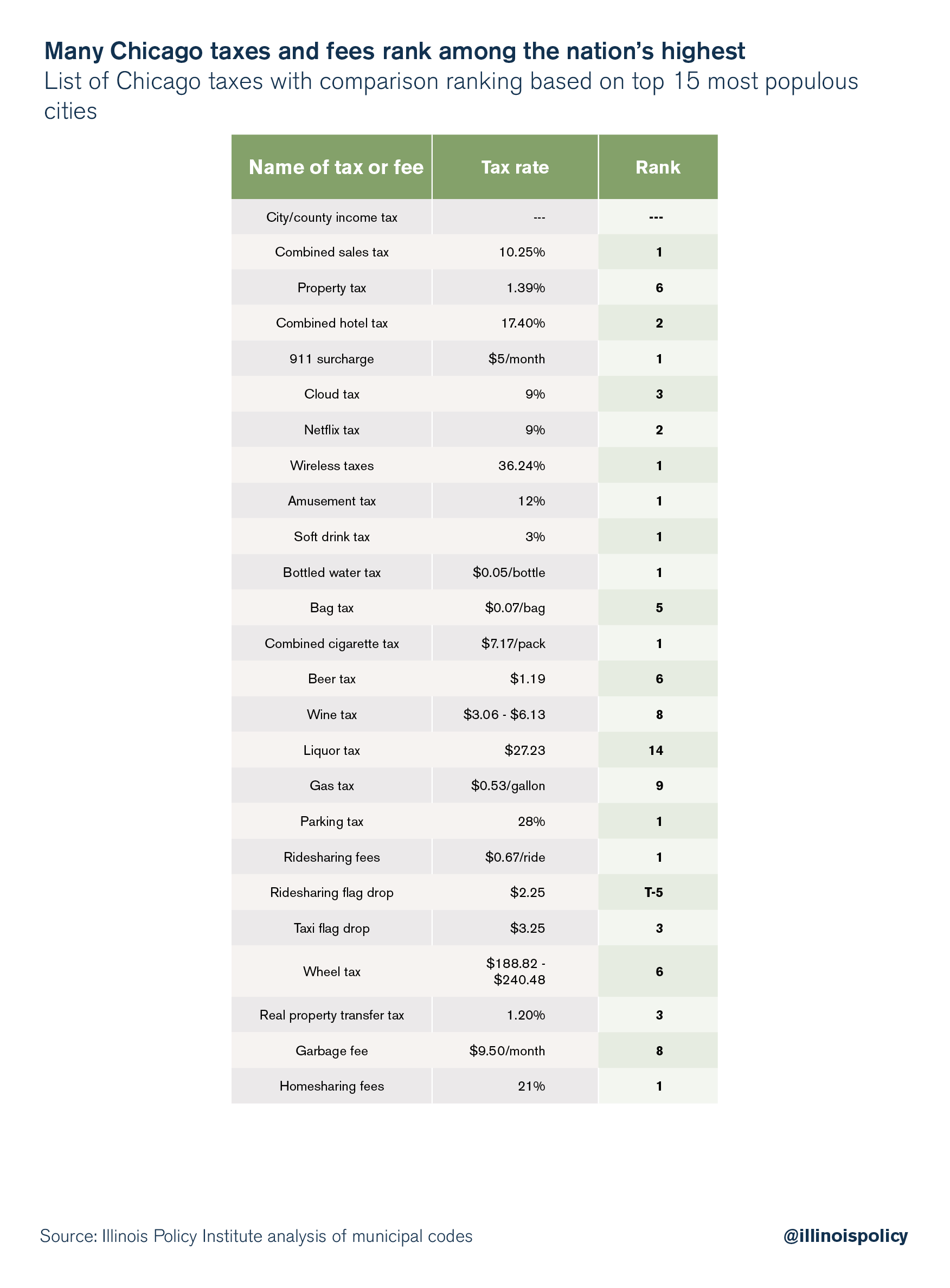

In addition to the Illinois state tax of 625 percent restaurant food purchases in Chicago are subject to Cook County tax of 125 percent and a Chicago city tax of 125 percent. Edwards County IL Sales Tax Rate. Roughly 55 of revenue for that fund was expected to come from sales taxes.

This is the total of state and county sales tax rates. Beginning May 2 2022 through September 30 2022 payments may also be mailed to. The part of naperville in dupage county had a 2005 tax rate of 57984.

The minimum combined 2022 sales tax rate for Dupage County Illinois is. Rates include the state and county taxes. Cook county 3681 tax assessor.

Sales taxes in illinois are calculated before rebates are applied so the buyer who pays 9500 after a 2500 rebate will still pay sales tax on the full 12000. As of February 2014. The base sales tax rate in DuPage County is 7 7 cents per 100.

This tax is applicable to all sales except qualifying food and drugs and titled vehicles. One of the reasons for this is that they are difficult to prepare properly. The City of Elmhurst pursuant to its home rule authority implemented a 025 local home rule sales tax effective September 1991.

Some cities and local governments in Dupage County collect additional local sales taxes which can be as high as 425. The 2018 United States Supreme Court decision in South Dakota v. Food Drug Tax 175.

Rates include the state and county taxes. Effingham County IL Sales Tax Rate. The sales tax in chicago.

Elmhurst Details Elmhurst IL is in DuPage County. Important Chicago Illinois Sales Tax Information. The Chicago area imposes the highest taxes on restaurant food items of any area in Illinois.

How much are taxes and fees on a new car in Illinois. 0610 cents per kilowatt-hour. What is the sales tax rate in Dupage County.

Sales tax returns or The Illinois Department of Revenue Form ST-1 are one of the most commonly audited forms or tax types in our state. Below is a list of standard sales and use tax rates for DuPage County. Downers Groves property tax bills are issued by DuPage County on or about May 1st of each year for the preceding tax year eg.

Effective January 1 2009 the home rule sales tax increased to 075. The base sales tax rate in DuPage County is 725 725 cents per 100. The latest sales tax rate for Elmhurst IL.

This is the total of state and county sales tax rates. Payments and correspondence may always be mailed directly to the DuPage County Treasurers Office at 421 N. The Tax Sale will be held on November 17 2021 and 19th if necessary in the auditorium at 421 North County Farm Road Wheaton Illinois 60187.

2020 rates included for use while preparing your income tax deduction. Sales tax is a huge money maker for Springfield. Payments must be received at the local bank prior to close of their business day to avoid a late payment.

A retailers occupation tax on the gross receipts from food prepared for immediate consumption alcoholic beverages and soft drinks is imposed on sales within Chicagos Metropolitan Pier and. The base sales tax rate in DuPage County is 7 7 cents per 100. 2020 rates included for use while preparing your income tax deduction.

Tax allocation breakdown of the 7 percent sales tax rate on General. What is the restaurant sales tax in DuPage county. As of February 2014.

Lowest sales tax 625 Highest sales tax 115 Illinois Sales Tax. The latest sales tax rates for all counties in Illinois IL state. Call the Hanover Park Finance Department at 630-823-5790 for additional information.

Is Food Taxable In Tennessee Taxjar

Chicago Il Sales Tax Store 54 Off Www Tritordeum Com

Illinois Sales Tax Guide And Calculator 2022 Taxjar

Groceries In Illinois Could Soon Be Tax Free Khqa

Chicago Il Sales Tax Store 54 Off Www Tritordeum Com

Chicago Il Sales Tax Store 54 Off Www Tritordeum Com

Chicago Il Sales Tax Store 54 Off Www Tritordeum Com

Chicago Il Sales Tax Store 54 Off Www Tritordeum Com

North Central Illinois Economic Development Corporation Property Taxes

What Is Illinois Sales Tax Discover The Illinois Sales Tax Rates For 102 Counties

Sales Tax Village Of Carol Stream Il

Illinois Sales Tax Calculator Reverse Sales Dremployee

Chicago Il Sales Tax Store 54 Off Www Tritordeum Com

How To Calculate Sales Tax Definition Formula Example

Map State Sales Taxes And Clothing Exemptions Trip Planning Map Sales Tax