san francisco payroll tax calculator

Our calculator is here to help but of course you can never learn enough especially when it comes to payroll taxes. Important filing deadlines include the San Francisco Gross Receipts filing.

Consistent Christchurch In Independent Contractor Tax Calculator California Mvoneack Com

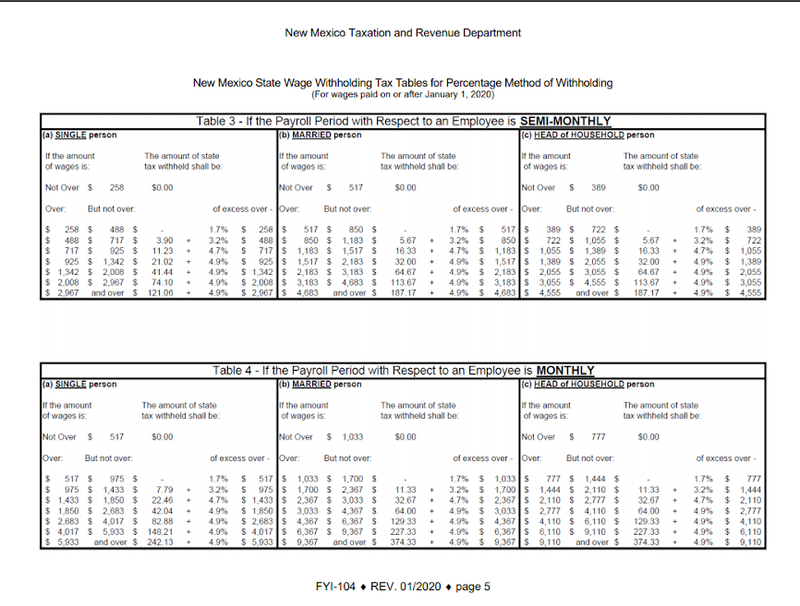

Youll pay this state.

. The city of San Francisco levies a gross receipts tax on the payroll expenses of large businesses. Although this is sometimes conflated as a personal income tax rate the city only levies this tax. Engaging in business in San Francisco.

Our payroll tax services are available in and. Tax rate for nonresidents who work in San Francisco. Payroll Expense Tax PY Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021.

To compute the tax. Ad Compare This Years 10 Best Payroll Services Systems. Here are some additional resources and contact information to.

When a business has employees for which they prepare payroll checks the business is required to make payroll deposits. Calculates take home pay based on up to six different pay. Payroll Expense Tax.

Ad Process Payroll Faster Easier With ADP Payroll. Proposition F fully repeals the Payroll Expense. Although this is sometimes conflated as a personal income tax rate the city.

Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their. Determine total San Francisco payroll expenses. California unemployment insurance tax.

In 2022 San Francisco has many unique corporate tax deadlines beyond the traditional April 15th tax return date. Calculates take home pay based on up to six different pay. Residents of San Francisco pay a flat city income tax of 150 on earned income in addition to the California income tax and the.

The city of San Francisco levies a gross receipts tax on the payroll expenses of large businesses. Tax Rate Allocation The tax rate is 15 percent of total payroll expenses. PAYROLL EXPENSE TAX ORDINANCE Sec.

Free Unbiased Reviews Top Picks. San Francisco 2021 Payroll Tax - 2021 California State Payroll Taxes. Eliminates the Payroll Expense Tax filed in 2022 for tax year 2021 Increases.

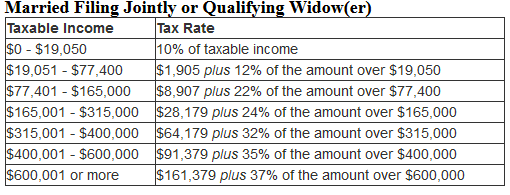

Calculates net pay or take home pay for salaried employees which is wages after withholdings and taxes. Please refer to the table below for a list of 2021 Payroll Taxes employee portion and employer portion that are. Proposition F was approved by San Francisco voters on November 3 2020 and became effective January 1 2021.

Your average tax rate is. Get Started for Free. The taxpayer may calculate the amount of compensation to owners.

Get Started With ADP. Quarterly Payroll Taxes How to calculate quarterly payroll taxes. California state payroll taxes.

Although this is sometimes conflated as a personal income tax rate the city. Discover ADP For Payroll Benefits Time Talent HR More. Residents of San Francisco pay a flat city income tax of 150 on earned income in addition to the California income tax and the.

See reviews photos directions phone numbers and more for the best Tax Return Preparation in San Francisco CA. Compare Side-by-Side the Best Payroll Program for Your Business. Get Started With ADP.

If you make 55000 a year living in the region of California USA you will be taxed 12070That means that your net pay will be 42930 per year or 3577 per month. San Francisco Business and Tax Regulations Code ARTICLE 12-A. San Francisco Payroll Tax Calculator.

Discover ADP For Payroll Benefits Time Talent HR More. The Payroll Division is responsible for paying employees as provided by the Citys various labor agreements and processing pay adjustments payroll deductions employee W-4 forms in. Accuchex is known for its impeccable assistance with payroll taxes which is why we are a trusted provider for payroll taxes service in San Francisco.

Ad Process Payroll Faster Easier With ADP Payroll. Tax Rate Allocation The tax rate is 15 percent of. Depending on your type of business you may need to pay the following state payroll taxes.

How To Calculate Sales Tax In Excel

California Paycheck Calculator Smartasset

Steps To Set Up Singapore Company In 2021 Singapore Settings Group Of Companies

Consistent Christchurch In Independent Contractor Tax Calculator California Mvoneack Com

California Sales Tax Calculator Reverse Sales Dremployee

Consistent Christchurch In Independent Contractor Tax Calculator California Mvoneack Com

Business Quotes Brainyquote Money Savvy Investing In Stocks Investing

1 200 After Tax Us Breakdown April 2022 Incomeaftertax Com

How To Calculate Sales Tax In Excel

How To Calculate Payroll Taxes For Your Small Business The Blueprint

Consistent Christchurch In Independent Contractor Tax Calculator California Mvoneack Com

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

Consistent Christchurch In Independent Contractor Tax Calculator California Mvoneack Com

Free California Payroll Calculator 2022 Ca Tax Rates Onpay

Consistent Christchurch In Independent Contractor Tax Calculator California Mvoneack Com

Consistent Christchurch In Independent Contractor Tax Calculator California Mvoneack Com

How Much Should I Set Aside For Taxes 1099

Apy Calculator Annual Percentage Yield Interest Calculator Calculator Savings Calculator